Combating Money Mule Threats with AI

ADI employs proactive detection against money mule threats with AI precision. This is how advanced technology mitigates financial risks.

In an era dominated by digital advancements, criminals lure unsuspecting individuals with tempting offers — quick cash and easy jobs. What might appear harmless is, in reality, a significant danger, fostering money mule operations that fuel organized crime and money laundering. Money mules, whether knowingly or unknowingly, unwittingly aid criminals in transferring illicit funds. Recognizing this challenge, the financial services industry faces the urgent task of promptly identifying and countering these activities, not only to adhere to regulatory mandates but also to protect customers.

In the relentless pursuit of financial security, ADI addresses the increasingly prevalent threat posed by money mule operations. From a reactive approach to proactive detection, our solution is fueled by the powerful synergy of data science and AI.

A Zero-to-Hero Dynamic Approach in Detection

Here’s the stark reality before — zero money mules detected through a manual and static process. The solution? ADI and its strategic partners embraced AI-driven detection — a dynamic, automated, and continual learning solution. The results are remarkable — demonstrating a strong level of detection and precision, and a staggering 80% reduction in false positives.

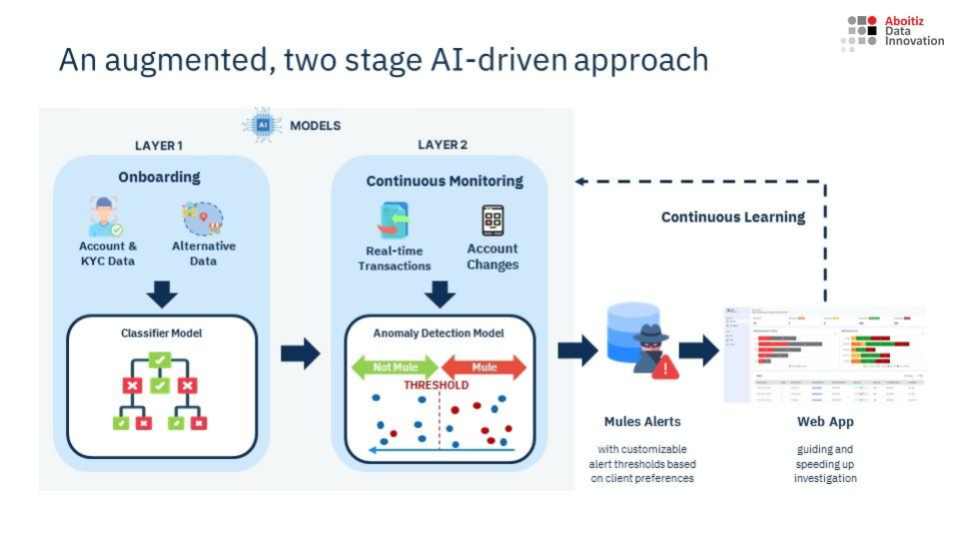

Our approach centers on a two-stage AI-driven solution. Initially, the model identifies potential money mules during account opening, sifting through customer-provided data and documents. This includes scrutinizing various valid forms of IDs and alternative data such as geographic data, to give a more holistic risk score of the individual and understand how the account is expected to be used.

Further, the model delves into transaction data, swiftly identifying changes in account behavior indicative of money mule activities. A perpetual feedback loop ensures ongoing model refinement, shaping the AI-powered engine into an all-encompassing, web-based solution. The dashboard delivers a streamlined alert management system, allowing effective prioritization tailored to an institution's risk appetite. The investigator's workflow—encompassing entity mapping, network analytics, and a customizable process—ensures a meticulous investigation.

AI and ADI’s Proactive Approach to Financial Security

Criminals adhere to established norms, but AI transcends these boundaries by identifying anomalies and exploring interdependencies through network analytics. Its system isn't merely reactive; it's a dynamic force that learns, adapts, and evolves. ADI continues to refine its features to make this solution scalable. Notable applications in the Philippines and Singapore illustrate the model’s prowess in identifying red flags, such as accounts opened by the same person in quick succession.

As the industry continues to combat financial crime, ADI's commitment to making AI work to address this remains unwavering. The future of financial security rests in proactive, intelligent detection, and we're proud to be part of this revolution.

Ready to forge a path towards a more secure financial future for all? Click here to empower your organization now!